How To Choose a Reputable Insurance Company

Navigating dentist disability insurance can be as laborious as cleaning teeth. Each plan comes with a different set of details, and each company offers a unique set of plans. Deciding how to choose a reputable insurance company may seem more challenging than deciding to become a dentist, but with the right guidance, you’ll be able to make the correct choice for your future.

You’ve already taken the right step toward deciding to secure dentist disability insurance. Protecting the future of your family and your business is never a poor investment. Keep reading to find out how to choose the right kind of insurance for your needs.

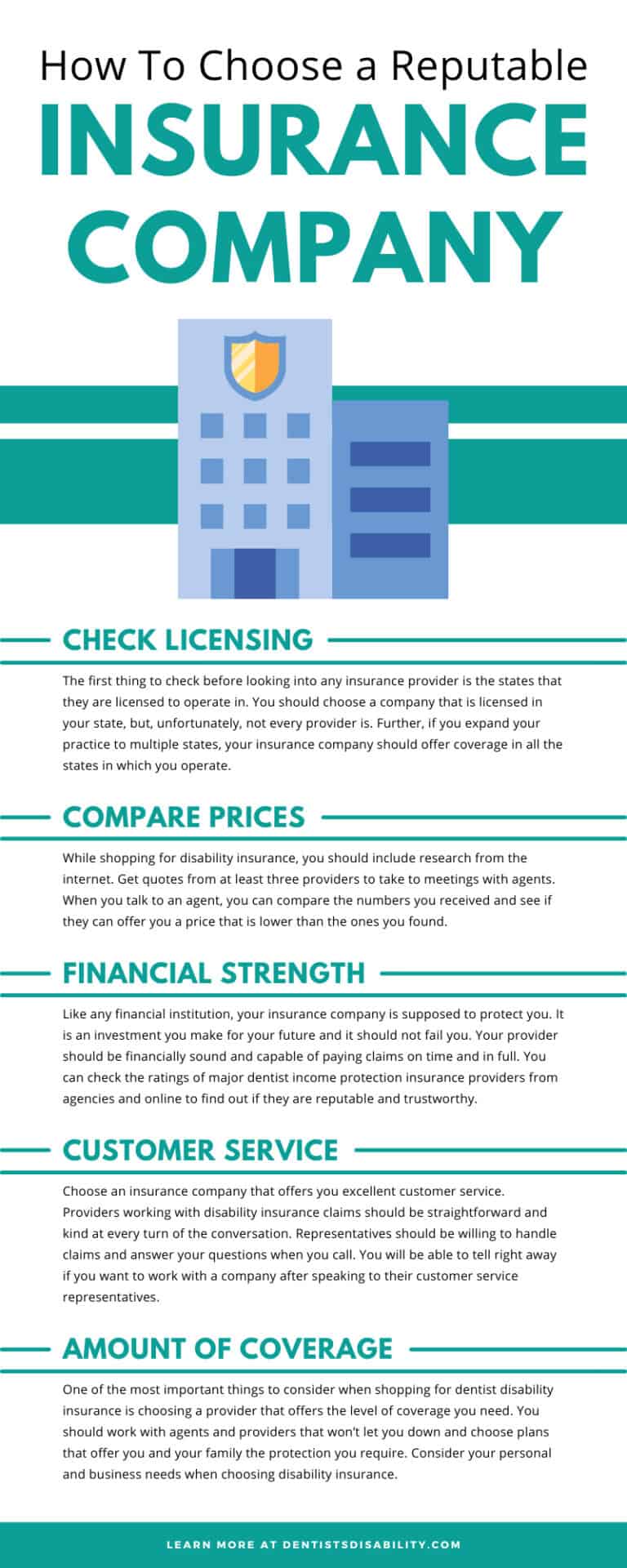

Check Licensing

The first thing to check before looking into any insurance provider is the states that they are licensed to operate in. You should choose a company that is licensed in your state, but, unfortunately, not every provider is. Further, if you expand your practice to multiple states, your insurance company should offer coverage in all the states in which you operate.

Compare Prices

While shopping for disability insurance, you should include research from the internet. Get quotes from at least three providers to take to meetings with agents. When you talk to an agent, you can compare the numbers you received and see if they can offer you a price that is lower than the ones you found.

Keep in mind that a low price doesn’t necessarily mean it’s the best option; you get what you pay for. A lower price may mean less coverage. For instance, while you may pay a lower premium, it could mean that when you file a claim, your company won’t insure as much of your income as you expected.

Pro Tip: Talk to your agent about which riders to include with your disability insurance so that it increases with the cost of living.

Financial Strength

Like any financial institution, your insurance company is supposed to protect you. It is an investment you make for your future and it should not fail you. Your provider should be financially sound and capable of paying claims on time and in full. You can check the ratings of major dentist income protection insurance providers from agencies and online to find out if they are reputable and trustworthy. When you need income protection, the last thing you should have to deal with is your insurance company negating to pay.

Customer Service

Choose an insurance company that offers you excellent customer service. Providers working with disability insurance claims should be straightforward and kind at every turn of the conversation. Representatives should be willing to handle claims and answer your questions when you call. You will be able to tell right away if you want to work with a company after speaking to their customer service representatives. Preferably, they will have a 24/7 help line and bill pay. Further, you can check reviews online to see if a company has complaints about its customer service.

Pro Tip: Before you choose a provider, ensure that their services are user-friendly, including their web site.

Name You Trust

Sometimes it is best to go with a provider you are comfortable with, and that may mean using a company that provides another insurance you already use. You can choose a provider you recognize as your health insurance, life insurance, or another type of insurance provider if they offer own-occupation disability insurance coverage. Many providers of dentist disability insurance are also popular providers of other insurances; companies include:

- Guardian

- MassMutual

- Ohio National Financial Services

- Ameritas

Amount of Coverage

One of the most important things to consider when shopping for dentist disability insurance is choosing a provider that offers the level of coverage you need. You should work with agents and providers that won’t let you down and choose plans that offer you and your family the protection you require. Consider your personal and business needs when choosing disability insurance. Think about the amount of coverage you will need for a growing family and in a changing world. For instance, you should choose a company that allows you to add riders that account for inflation and your rising income.

Agent Vs. Provider

Using an agent may seem like the more expensive path in the long run, but agents have the knowledge to guide you through the difficult world of disability insurance. Each company offers something different and trying to keep these details straight could end up costing you more time and money. Leave the heavy lifting to the experts and talk to a professional about which options are best for you. Working with providers yourself could end up costing you more if you invest in a plan that you end up dropping.

Build a Relationship With Trusted Agents

Insurance agents build relationships with providers to help you get the best rates on your premiums. Further, agents have access to package deals that may help you acquire your dentist disability insurance for a lower rate than having gone straight to the provider. Insurance agents know the ins and outs of each company so that they can find the best fit for you and your business.

Choose a Trusted Agent

While you may hear about agents who add riders and steer you toward the wrong coverage due to behind-the-scenes incentives, you can find a trusted agent by checking reviews online or getting a referral. Talk to friends, family, and neighbors to find out if they have worked with an agent. Further, you can read online dentist community boards to find out which providers that dentists like you are using the most.

Knowing how to choose a reputable insurance company does not come naturally, and they don’t talk about it at medical school. Investing in dentist income protection insurance is the best way to protect your income and the well-being of your family. Know that you will be safe when you are in the right hands. Let the agents at Dentist Disability Insurance guide you with our unbiased advice and expertise about the nation’s top own occupation disability insurance providers. Our professionals are superior at recommending insurance plans from the best insurance companies. Visit our website to request a quote.

[…] is to invest in your own individual health insurance plan, for which you will be responsible for choosing a reputable insurance company. Individual health insurance is necessary if you own your own […]